Popular Tips

YOU MIGHT BE INTERESTED IN

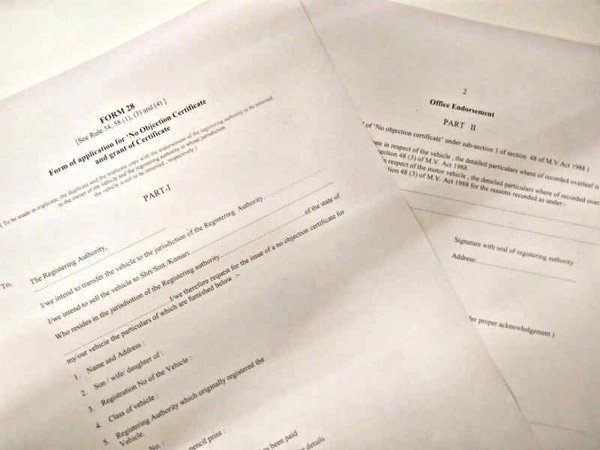

How To Inter-State Transfer The Vehicle Ownership Registration?

by Mohammed Burman |

30/11/2020

This article is going to provide you with the detailed guidelines on how to transfer the ownership registration of the vehicle from one state to another.

Follow us on google news

Follow us on google news