Popular Tips

YOU MIGHT BE INTERESTED IN

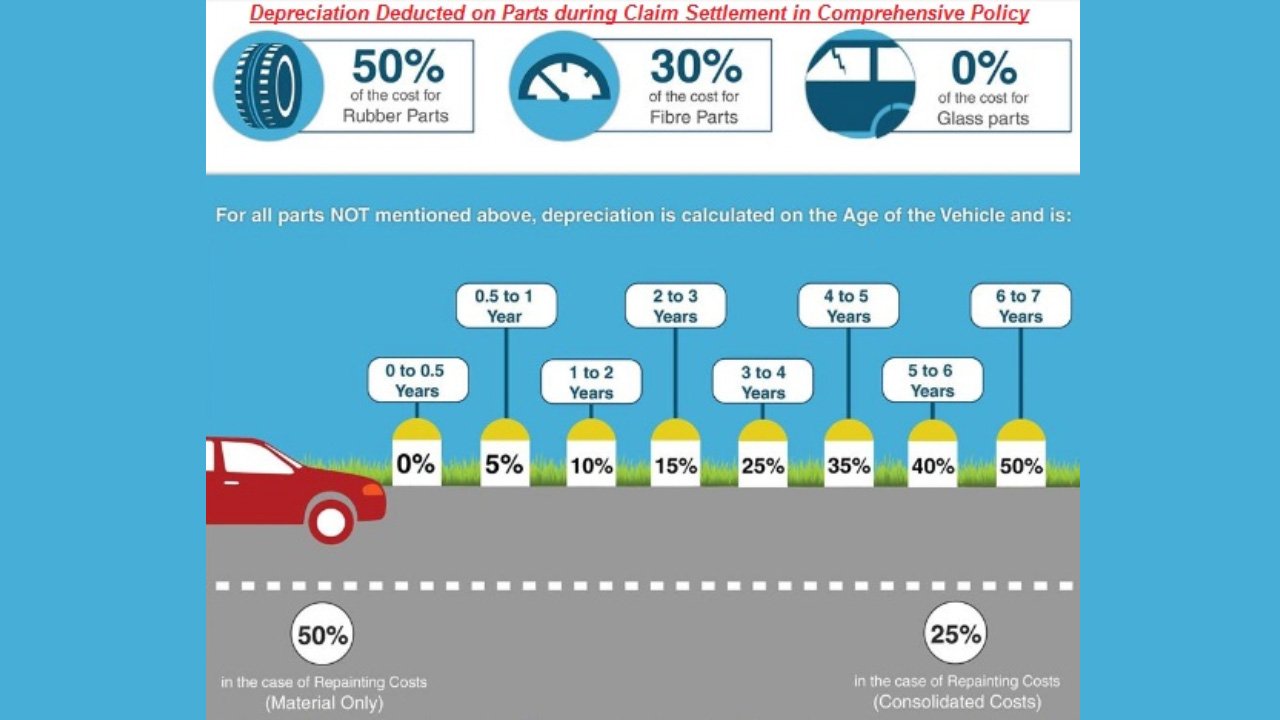

What Is Zero Depreciation Car Insurance?

by IndianAuto Team |

03/08/2020

Do you know that car insurance companies often pay less than the repairing cost because your car loses value? Opt for a zero depreciation car insurance to earn more!

Follow us on google news

Follow us on google news