Popular Tips

YOU MIGHT BE INTERESTED IN

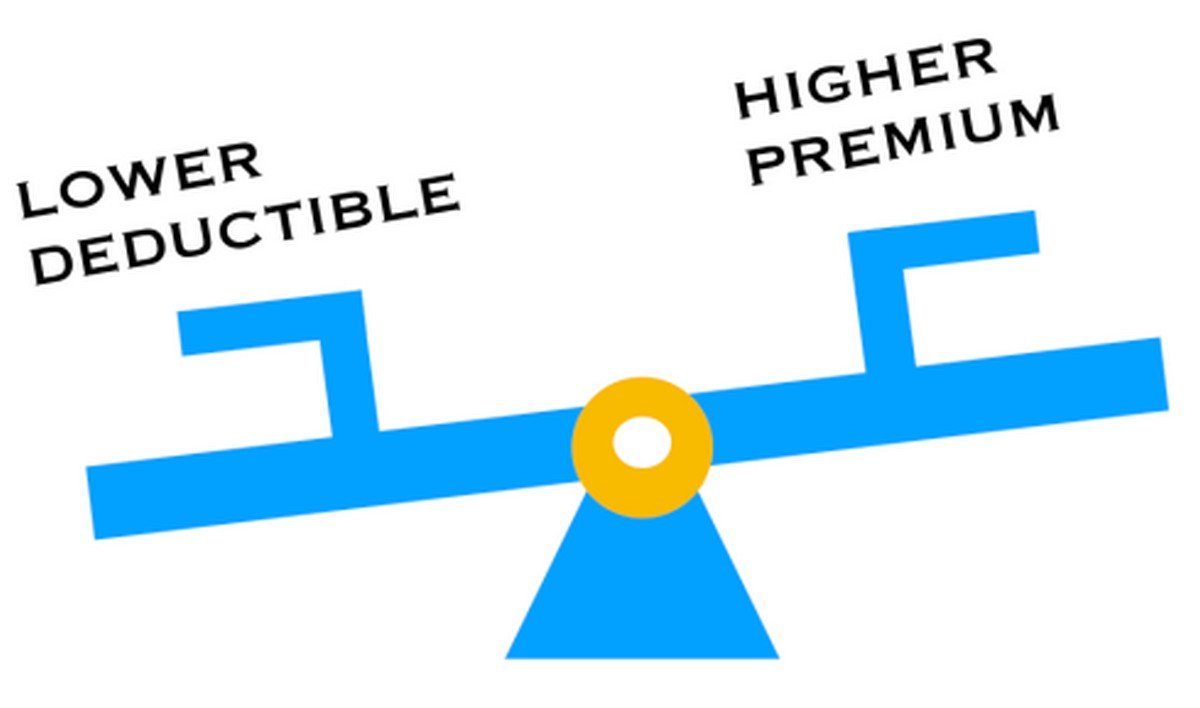

All Things You Should Know About Car Insurance Deductible

by Vivaan Khatri |

07/08/2020

Car owners must be familiar with the concept of car insurance deductibles. If you are new to the world of car insurance, we will provide you with all the key things you should know about car insurance deductible.

Follow us on google news

Follow us on google news